The true cost of 30 year loans!

- REGINALD POWELL

- Feb 21, 2023

- 2 min read

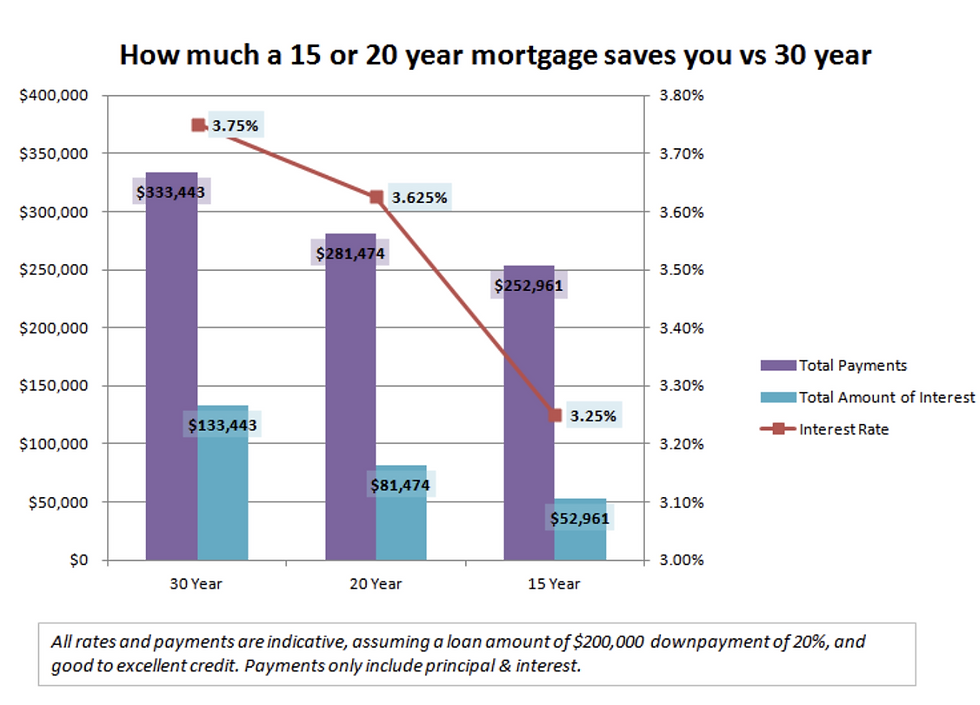

According to Freddie Mac, 90% of home owners buy a home on a 30 year loan. There is a very good chance that if you are a homeowner, you bought it with a 30 year loan as well. Did you know that by buying a home with a 30 year loan vs. a 15 year loan, you can pay almost double the cost of the original price of the home?

This is a topic I am very passionate about. Unfortunately, only a few people I have talked to over the years took my advice and used either a 15 or 20 year loan term. What’s the most common reason people don’t take my advice? They always say it’s just too expensive. They say they can’t afford the higher monthly mortgage. The more important question to ask yourself is; can you afford to throw away hundreds of thousands of dollars in interest? I can’t.

I was talking with a coworker yesterday and this came up. He was preparing his taxes and didn’t know how much interest he paid on his new home. I walked him through the numbers. He is a military veteran. He bought his house with zero percent down. Yes, zero percent. He bought it on a 30 year loan at a 5% interest rate. The home he bought was over $800,000. He currently pays over $3,500 every month on interest. He pays more on just interest than I pay on my entire mortgage. Not only that, but my loan will be paid off 15 years earlier than his. That is a huge difference.

For those new to this, a home loan is amortized over the life of the loan. What this means is that the interest is front loaded. Over the years, you pay less in interest and more in principal (the actual equity in the home). On the loan he has, he doesn’t start paying more principal down than interest until YEAR 17! For 17 years, he is paying more in interest monthly than principal. To make this whole scenario even worse, if he had just initially bought it on a 15 year loan, it would be paid off already!

This scenario is a bit extreme , since he put zero percent down, but it shows just how important loan terms are. I personally am a fan of 20 year loans now and I think its best to put down a minimum of 10%. Everyone’s personal situation is different obviously, but the less you pay in interest, the better. Affordability is huge. if the house you are looking at is too expensive, than find another house that is cheaper and will fit your needs. Over the long term, you will be much happier living in a more affordable home. You can spend more time living and less time working to pay off the mortgage.

Below is a link to an article that shows a comparison of a 15 vs. 30 year loan with rocket mortgage.

Comments